28+ Tax Donation Calculator

In order to claim a deduction for donations they must be for a tax-exempt charity that is recognized by the IRS. Web The calculator will display the net cost of the donation and the tax savings.

Tax Calculator Vanguard Charitable

Please choose a value within this range that reflects your items relative age and quality.

. If your non-cash donated item is valued at less than 250. Web How do I determine the value of donated items. Tax Return and Refund Estimator 2023-2024 Key IRS Tax Forms Schedules Publications for 2023 Capital Gains Tax.

Web The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving. Another way to exceed the higher standard deduction is by bunching donations which is a popular strategy for donor-advised funds experts. To determine the fair market.

Make a Tax-Deductible Donation with Baitulmaal. Web The IRS requires an item to be in good condition or better to take a deduction. The Salvation Army does not set a valuation on your.

This charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift. Web To help you navigate the latest IRS tax updates from 2022 to 2023 weve put together a guide including the updated tax brackets charitable deduction limits how. Web Take a moment to see how much you can save on your taxes by using our software when you itemize.

Web Tax Savings Donation Calculator Est. Net cost of donation. Web Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may help save even more.

Web To get started Download the Goodwill Donation Valuation Guide which features estimates for the most commonly donated items. Donation Value Filing Type Est. Web Published Nov 28 2023 600 am.

Web The difference is one is subtracted and one is not added. Click Calculate to view a chart that compares the after-tax benefits of contributing long-term. Web 1-800-SA-TRUCK 1-800-728-7825 The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items.

Tax Return and Refund Estimator 2023-2024 Estimate how much youll owe in federal income taxes for tax year 2023 using your income. Web 14 rows Discover the impact a charitable donation can have on your taxes. Web Federal Income Tax Calculator.

Web To see the potential impact of such a contribution try using this calculator. Web Find out the best ways to maximize year-end giving through donations to respected and well-regarded charities that match your passions and make good use of your generosity. Ad Turn compassion to hope this giving season.

Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they dont. It includes low and high estimates. However if the amount you originally paid for the.

Web Your income tax charitable contribution donation of paintings antiques and other objects of art for which you claim a deduction of more than 5000 must be supported by a. Use our interactive tool to see how giving can help you save on. You may be surprised to learn that you can afford to be even more generous than you thought.

Web Federal Income Tax Calculator. This calculator determines how much you could save based on your donation and place of. Most of the time it will be the fair market value FMV of your item.

Join Baitulmaal in spreading hope compassion with your year-end tax-deductible donation. Taxable Income Your Estimated Savings Is. Our donation value guide displays prices ranging from good to like-new.

How To Make A Receipt On Excel

Compass Clock Fall Winter 2018 Publication Pdf

Arnprior Chronicle Guide Emc By Metroland East Arnprior Chronicle Guide Issuu

8 Year End Charitable Giving Strategies Schwab Charitable Donor Advised Fund Schwab Charitable

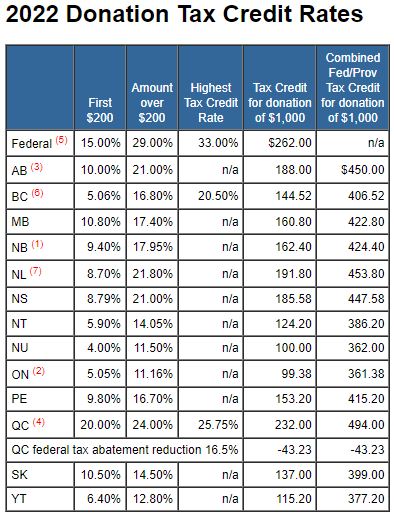

Taxtips Ca 2022 Donation Tax Credit Rates

Donation Tax Calculator Good2give

Grifols Sa United States Securities And Exchange Commission Washington D C 20549 Form 6 K Report Of Foreign Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934 For

Charitable Donations Tax Credits Calculator Canadahelps

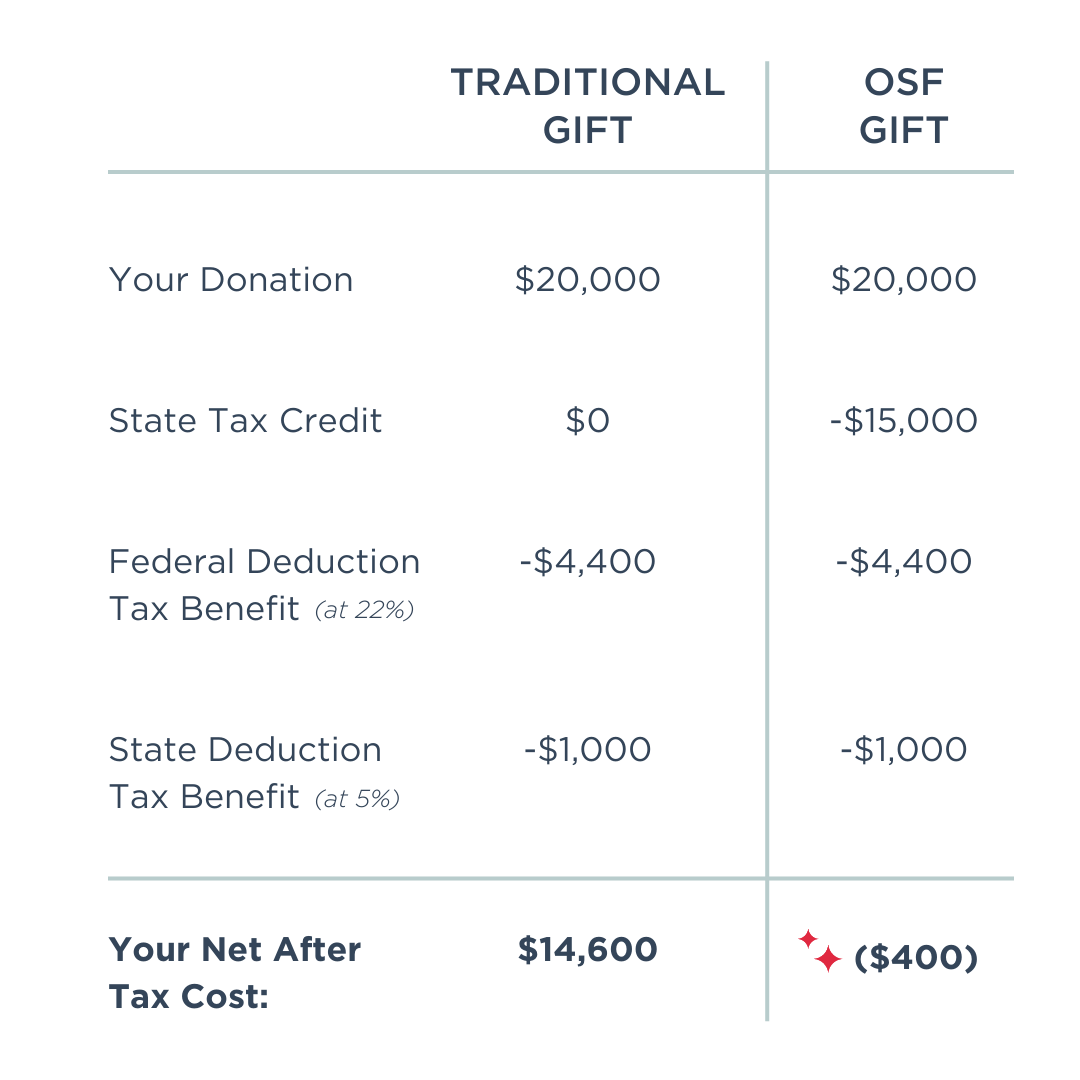

Business Donations Opportunity Scholarship Fund

Tax Savings Donation Calculator

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

8 Year End Charitable Giving Strategies Schwab Charitable Donor Advised Fund Schwab Charitable

Taxation Mba Pdf Expense Tax Deduction

Paying For Children S Education Can Be Taxing The Cpa Journal

Tax Savings Donation Calculator

Prepare For The Insurtech Wave

Hisarah S Travels On Nomad List